Contact us: Email: AFEUS@afe-foundation.com

Discover AFE US

THE ENTIRE PURPOSE OF AFE US IS TO GIVE BILLIONS OF ORDINARY FAMILIES A CHANCE TO CHANGE THEIR DESTINY THROUGH AI.

Learn About Our Company

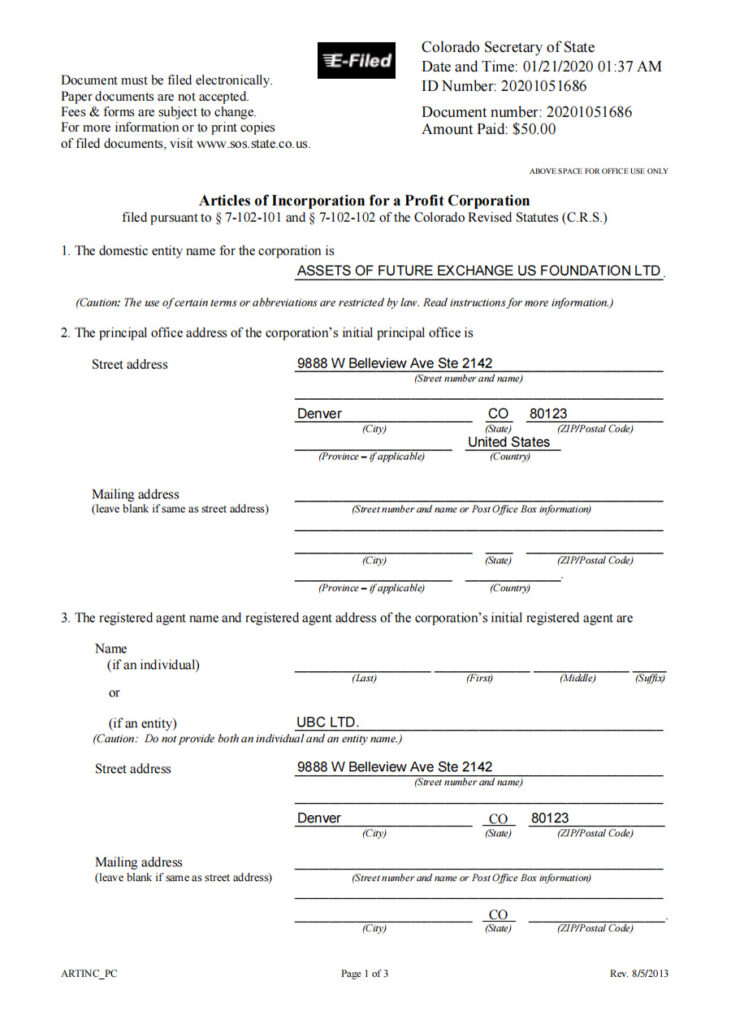

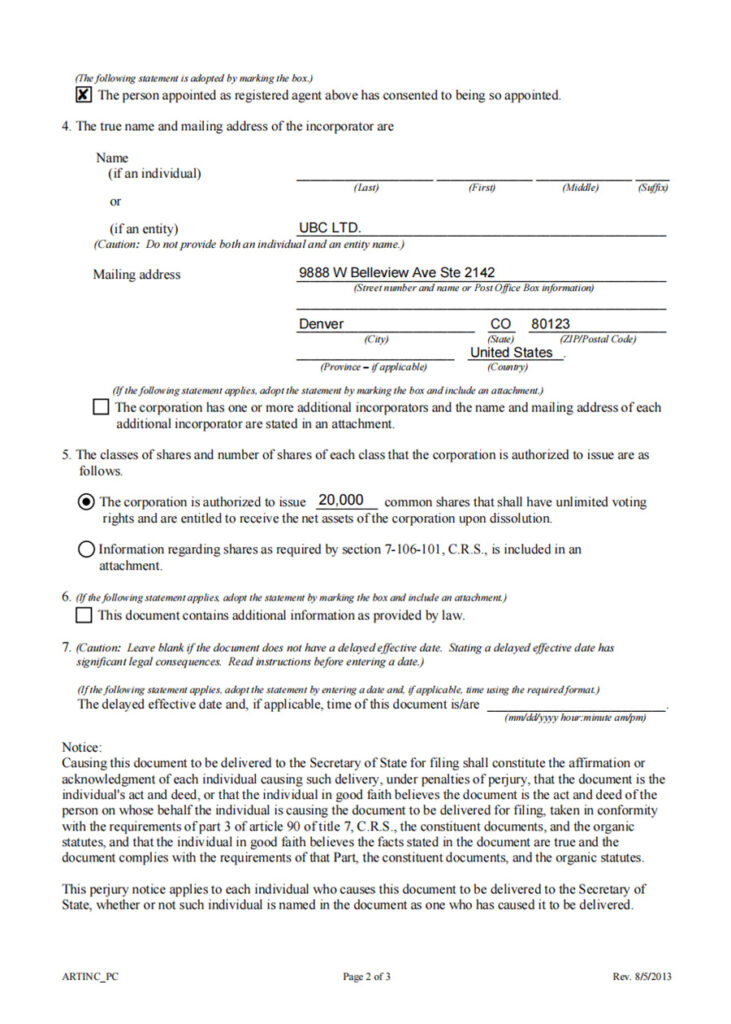

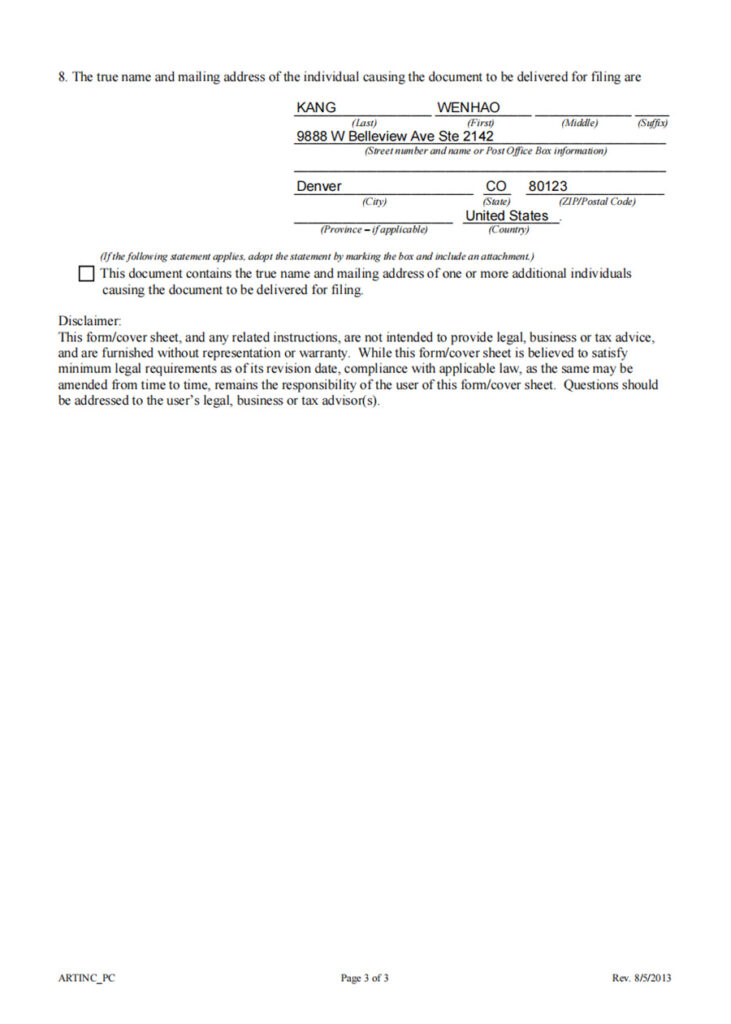

Assets of Future Exchange US Foundation Ltd (referred to as AFE Foundation or AFE US) is an AI-driven financial technology platform founded by Michael Bennett in January 2020 in Denver, Colorado, USA.

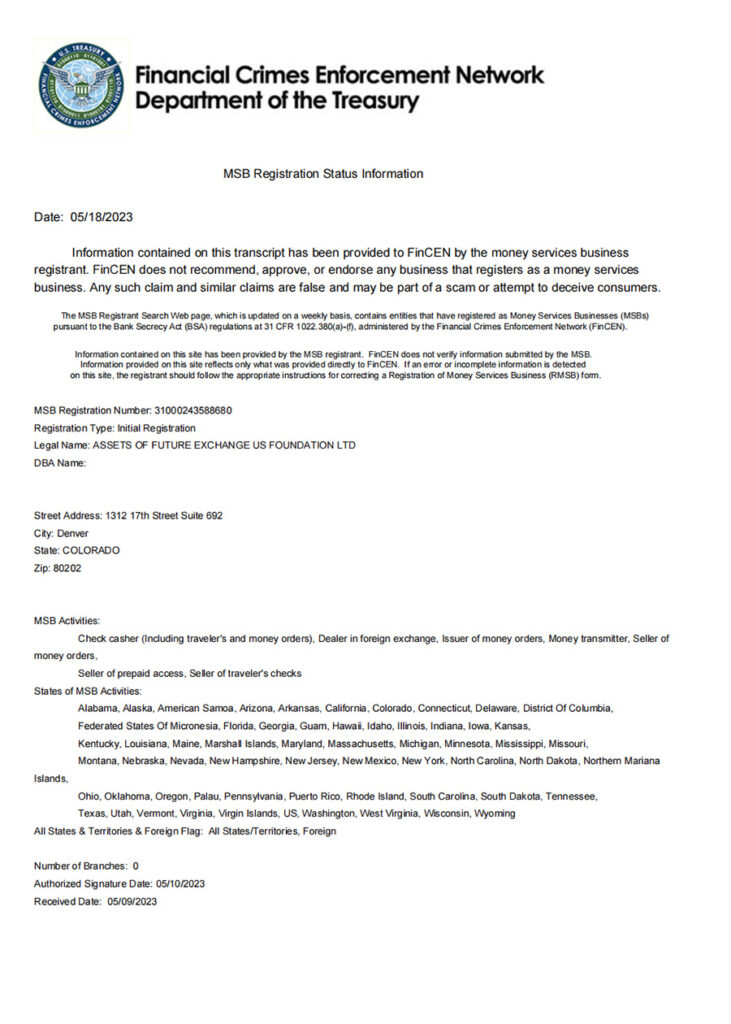

In 2023, AFE US obtained a Money Services Business (MSB) license issued by the Financial Crimes Enforcement Network (FinCEN) under the U.S. Department of the Treasury, as well as a Certificate of Good Standing from the Colorado Secretary of State.

The company is dedicated to promoting inclusive finance through artificial intelligence. Guided by three core principles—algorithmic transparency, low service thresholds, and evolutionary inclusiveness—AFE aims to build an open AI financial infrastructure that empowers individual and small-scale investors with decision-making tools comparable to those used by institutions.

AFE AI 3.0 is our fully self-developed AI-powered securities investment system.

Its core technologies include the Regulatory Sentiment Fission Engine and the Dark Pool Liquidity Modeling Engine, which enable accurate prediction of market risks and identification of investment opportunities.

The system once issued a 72-hour advance warning before a regulatory crisis at the parent company of Paytm, ultimately achieving a 409% return on investment. It also identified seven high-growth stocks in the Indian SME market that each delivered over 10x returns.

From May 2024 to May 2025, we conducted a successful year-long public beta test of AFE AI 3.0 across Europe and North America.

The test involved 200 users from 8 countries—including the United States, Mexico, France, Germany, the United Kingdom, and Italy—representing 12 different professional backgrounds.

An average ROI of 328.7% was achieved, validating the generalizability and feasibility of the AI system across various industries and investor segments.

Following the release of the test results, AFE US attracted strong interest from two top U.S. venture capital firms: Kleiner Perkins Caufield & Byers (KPCB) and Sequoia Capital CV IV Holdco v, Ltd, both of which expressed clear investment intentions.

To further test the AI system’s adaptability in human-dominated environments, we are developing a bidirectional evolution model that links human emotional feedback to AI-driven strategic adjustment, with the goal of realizing true financial democratization through AI.

We are currently preparing the launch of a large-scale collaborative AI behavior experiment involving tens of thousands of participants, in a pioneering effort to explore new forms of human-AI interaction.

Looking ahead, we plan to launch an institutional-grade API platform in 2026, with annual subscription fees starting at $500,000, and to expand into the U.S. stock market and cryptocurrency assets.

We strictly adhere to regulatory requirements, and all data sources are fully legal and compliant.

As our founder Michael Bennett puts it:

“We are committed to making AI in finance a force for equity in the markets—not a tool that widens the gap between rich and poor.”

《Company Registration Certificate》

《Certificate of Good Standing》

《MSB License》

Meet Our Founder

Michael Bennett, Ph.D. in Computer Science from Stanford University, is a leading figure in the field of AI-driven financial technology. He is the founder and CEO of AFE US. The next-generation financial trading system he developed, AFE AI 3.0, has attracted significant interest from two top-tier U.S. venture capital firms: Kleiner Perkins Caufield & Byers (KPCB) and Sequoia Capital CV IV Holdco v, Ltd.The system’s core algorithms—the Regulatory Sentiment Fission Engine and the Dark Pool Liquidity Modeling Engine—have delivered an impressive annualized excess return of 45%.

Michael Bennett, Ph.D. in Computer Science from Stanford University, is a leading figure in the field of AI-driven financial technology. He is the founder and CEO of AFE US. The next-generation financial trading system he developed, AFE AI 3.0, has attracted significant interest from two top-tier U.S. venture capital firms: Kleiner Perkins Caufield & Byers (KPCB) and Sequoia Capital CV IV Holdco v, Ltd.The system’s core algorithms—the Regulatory Sentiment Fission Engine and the Dark Pool Liquidity Modeling Engine—have delivered an impressive annualized excess return of 45%.

Prior to founding AFE US, Michael led the development of a high frequency trading risk control system at the JP Morgan AI Lab, successfully reducing abnormal trading risk by 27%. He also pioneered the application of deep learning to optimize financial derivatives pricing models at Google DeepMind. Michael holds Four AI based financial patents, and his market impact simulation technology based on Genarative Adversarial Networks (GANs) has been adopted as an industry standard by several top global investment banks.

Michael Bennett’s core vision is to “Democratize Finance through AI”, advocating for the elimination of information barriers so that both institutional and retail investors can access intelligent decision-making tools on an equal footing. He introduced the “Three Principles of Borderless Finance”: Algorithmic Transparency, Low Entry Barriers, and Inclusive Evolution. He is committed to building AFE AI 3.0 into an open AI financial infrastructure that empowers small and mid-sized investors to navigate systemic risks.

His ultimate goal is to reconstruct the power structure of finance through AI, ensuring that technology becomes “a force for market equity, not a tool that widens the wealth gap.”

Meet Our Team

KOK SIONG PUA|Chief Executive Officer

KOK SIONG PUA holds a Ph.D. in Finance and is a fintech leader known for his strategic vision and technical acumen. With a long standing focus on the integration of artificial intelligence and financial markets, he has developed deep expertise in areas such as AI driven stock selection systems, cross-border capital operations, and U.S. securities regulatory compliance. Since becoming CEO of AFE US in 2020, he has led the company through a comprehensive build out of its AI securities analysis platform and successfully expanded its global market presence, serving investors across multiple countries and regions. With deep insight into capital market trends and precise execution in applying technology, Kok Siong Pua has become a key figure in driving the global adoption of intelligent and democratized AI investing. Possessing a broad international perspective and fluency in both Chinese and English, he demonstrates outstanding leadership in guiding teams through innovation and breakthrough, while elevating the company’s global influence. He is recognized as one of the pivotal leaders in the development of the global financial AI industry.

Isabella|Chief Customer Officer(CCO)

Isabella is the current Chief Customer Officer (CCO) at AFE US, with 12 years of experience in multinational client strategy. She is widely recognized as an expert in customer relationship management. She led the development of the “Platinum Client System,” achieving a 98% retention rate among the top 20 clients, and successfully implemented several flagship cases in the financial and healthcare AI sectors, earning a customer satisfaction score of 4.9 out of 5. During her tenure, Isabella designed and executed a global tiered customer strategy, which resulted in a 2.4x increase in contract value, and built a multilingual service team covering English, French, and Spanish. Before joining AFE US, Isabella served as Client Director at KPCB International Consulting (2015–2021). She specialized in data driven customer decision frameworks, with a strong track record in building high-net-worth client ecosystems and executing multinational business strategies.

Cole Harrison|AFE US Securities Analyst

Cole Harrison is currently a Securities Analyst at AFE US. He previously served as Chief Valuation Architect at JP Morgan and was the Founding Strategy Officer of Black Rock’s Disruptive Technology Fund. He has been named a " All Star Technology Analyst" three times by Institutional Investor (2022). Notable Achivements include: · Successfully shorting Theranos in 2016, yielding a 327% return · Training a GPT-4based financial language system, tripling research report generation efficiency · Developing the "Patent Cliff Prediction Algorithm" and the "Unicorn Pre-IPO Monitoring System" Cole holds a background in Computational Finance from MIT, is the youngest strategic commentator in CNBC’s history, and a financial influencer on YouTube with 2.8 million followers focused on quantitative analysis.

Edmund Sterling|AFE US Securities Analyst

Edmund Sterling is currently a Securities Analyst at AFE US. He previously served as Chief Strategist in Morgan Stanley’s European Equity Research Division and was a member of Investment Committee at Schroders Global Asset Management. In 2023, he was ranked No. 1 on the Financial Times list of “Top Equity Forecasters in UK.” Renowned for his accurate market predictions, his notable achievements include: Identifying Oxford Biomedica early in 2020, generating a +323% return. Issuing a warning on Credit Suisse’s AT1 Bond risks 6 month in advance, earning widespread recognition across the industry He originated the "Westminster Political Risk Model" and holds a patent for the "LME Copper Inventory–GBP Exchange Rate Algorithm." Edmund holds a double degree in Mathematics and Philosophy from the University of Oxford. Early in his career, he worked in the elite strategy teams at Goldman Sachs and Morgan Stanley, combining a strong academic background with practical experience at top international investment banks.

James Anderson|AFE US Chief Technology Officer(CTO)

James Anderson is the Chief Technology Officer (CTO) of AFE US and holds a Ph.D. in Computer Science from MIT. He has 12 years of experience in the AI driven fintech sector. He helped lead the development of the AFE AI 3.0 intelligent investment system, which achieves an average annual excess return of 45%, and built an AI research team of 50 members. He also designed an anti-fraud system that reduced the bad debt rate by 37%. Before joining AFE US, James served as Head of AI Engineering at JPMorgan’s AI Lab and was a Senior Engineer at Stripe. His expertise includes algorithmic trading, deep learning, blockchain, and risk control systems. He holds two AI related financial patents. James has been recognized as one of the “Top 10 Fintech CTOs Worldwide” and is dedicated to building intelligent and open financial infrastructure through technology.

Ryan Mitchell|AFE US(General Counsel)

Ryan Mitchell, General Counsel of AFE US, graduated from Columbia Law School. He has 15 years of experience in legal affairs and regulatory compliance for multinational corporations, specializing in AI fintech, cross-border mergers and acquisitions, and data privacy management. He previously led multiple cross-border transactions at the internationally renowned law firm Latham & Watkins LLP. Later, he served as Senior Legal Counsel for Global Compliance at PayPal, where he was deeply involved in the implementation of GDPR (General Data Protection Regulation) and fintech regulatory matters. Since joining AFE US, Ryan has spearheaded the legal and compliance processes for the company’s $30 million financing round with KPCB, promoted the development of internal AI ethics and data protection policies, and built a multilingual legal team. He plays a key role in AFE US’s expansion into the U.S. stock market and the crypto asset sector. Ryan is a licensed attorney in New York State and holds two international privacy certifications: CIPP/US and CIPP/E.